irs unveils federal income tax brackets for 2022

401 k income limits. Importantly the 2021 brackets are for income earned in 2021 which most people will file taxes on before april 15 2022.

Irs Announces 2016 Tax Rates Standard Deductions Exemption Amounts And More

How much will you owe from papers and blogs.

. Taxpayers earning more than 539900 or 647850 are hit this rate. In 2022 individuals under the age of 50 can contribute 20500. Federal income tax brackets 2022.

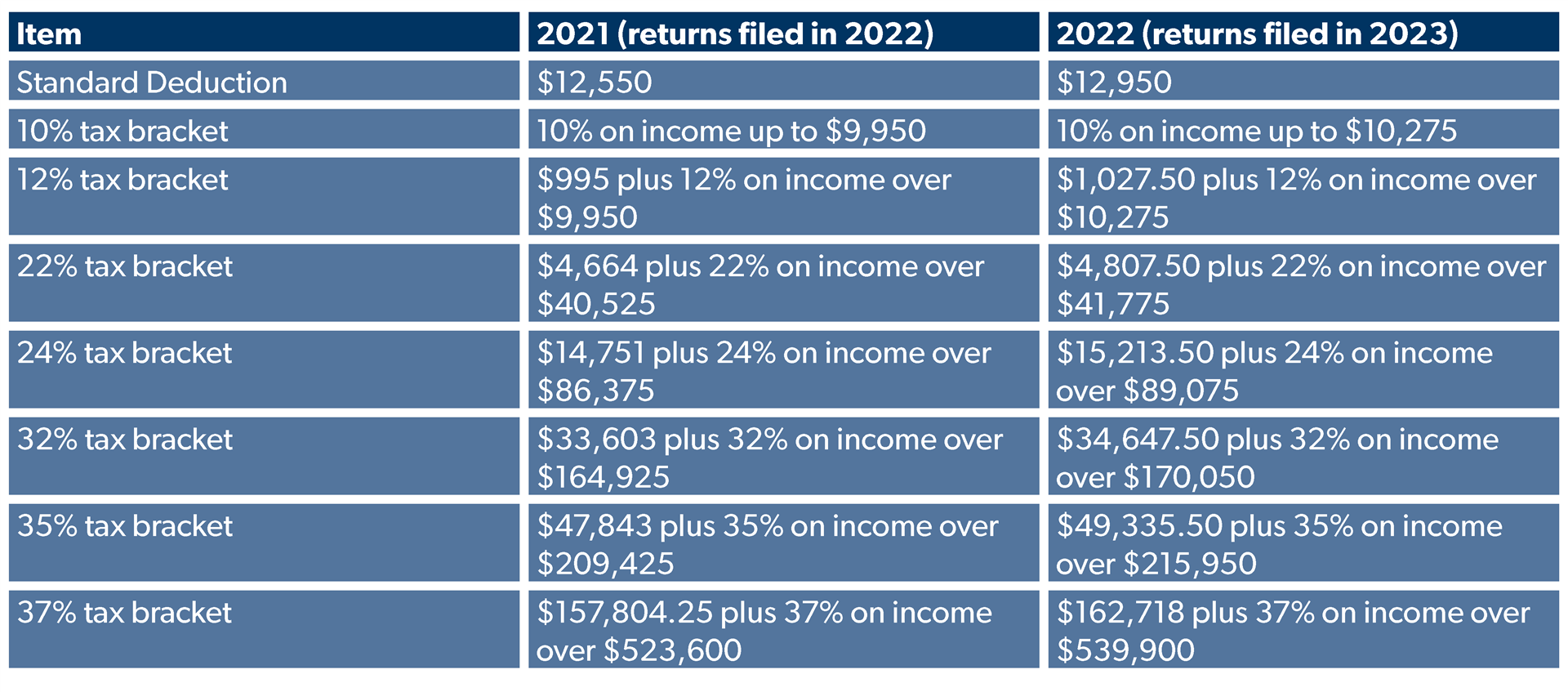

The capital gains tax rates will remain the same in 2022 but the brackets will change. For 2022 theyre still set at 10 12 22 24 32 35 and 37. The seven tax rates themselves are unchanged but income limits for each bracket have been adjusted for inflation according to CNBC.

The amount for heads of household is 55800. If you file jointly with your spouse and you each made 45000 in 2019 your total income subject to income tax barring deductions is 90000. The income limits are unchanged but the cutoff amounts have been increased for inflation.

Here are the new thresholds for the nations seven tax brackets in 2022. November 12th 2021 under General News Law Enforcement News PeruRegional History. The standard deduction claimed by most taxpayers will also increase for 2022 rising to 25900 for married couples filing jointly and.

The standard deduction for married couples filing jointly for tax year 2022 rises to 25900 up 800 from the prior year. The 2022 tax brackets affect taxes that will. 8 rows In 2022 the income limits for all tax brackets and all filers will be adjusted for.

The personal exemption for tax year 2022 remains at 0 as it was for. The top marginal income tax rate is 37 percent. The 2022 tax brackets affect taxes that will be filed in 2023 CNBC said.

51 Agricultural Employers Tax Guide. The IRS did not change the federal tax brackets for 2022 from what they were in 2021. The tax items for tax year 2022 of greatest interest to most taxpayers include the following dollar amounts.

Ad Compare Your 2022 Tax Bracket vs. There are still seven in total. There are seven federal income tax brackets in 2022.

For 2022 theyre still set at 10 12 22 24 32 35 and 37. The standard deduction is also increasing 400 for single filers and 800 for. The IRS has announced new federal income tax brackets for 2022.

Discover Helpful Information And Resources On Taxes From AARP. The seven tax rates themselves are unchanged but income limits for each bracket have been adjusted for inflation according to CNBC. For a married.

10 announced that it adjusted federal income tax brackets for the 2022 tax year meaning the changes will impact tax returns filed in 2023Wi. For 2022 the maximum zero rate taxable income amount will be 83350 for married couples filing jointly and for surviving spouses. For taxation of corporate income the tax bracket applicable to corporations is the 15 tax bracket.

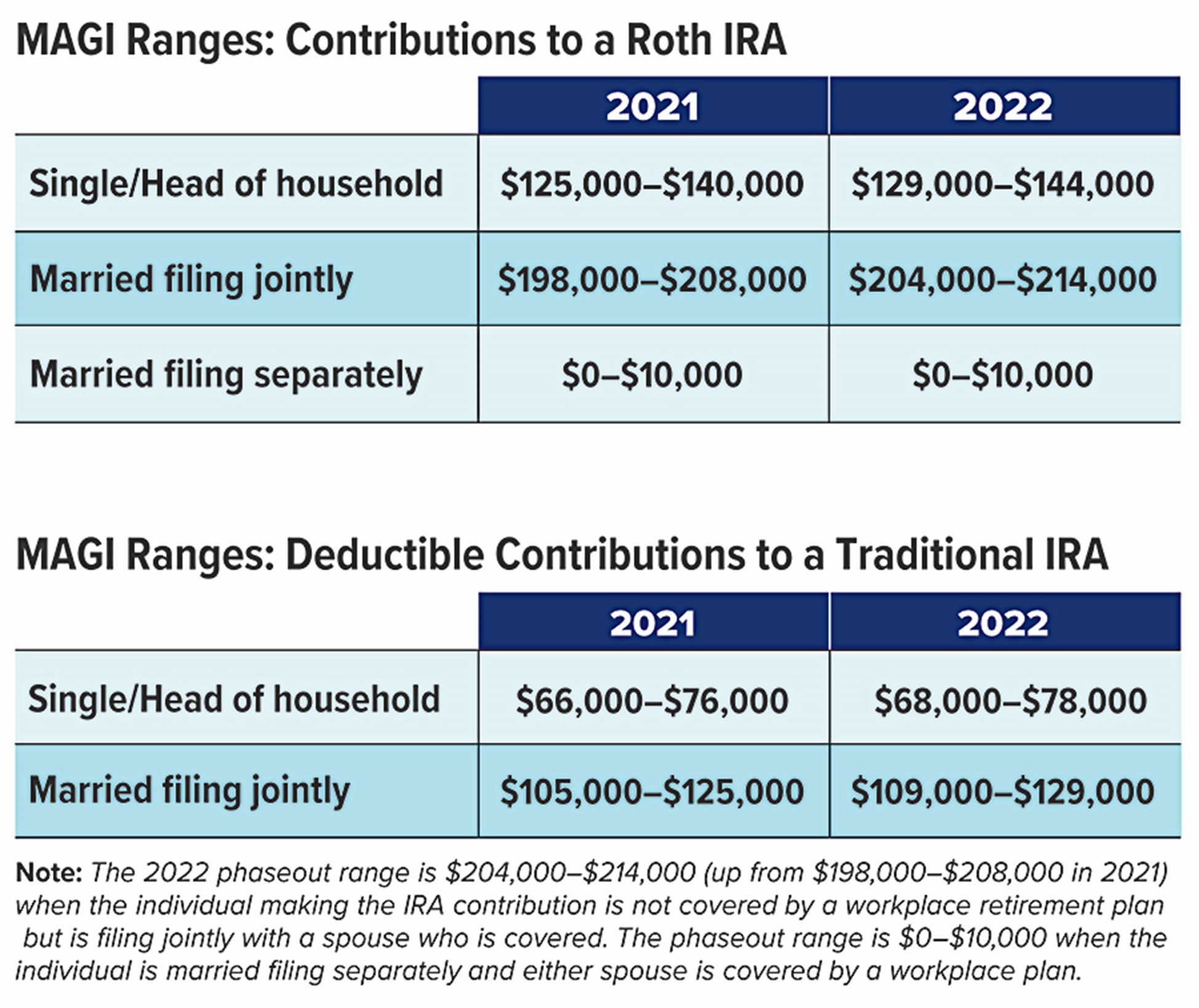

New federal tax brackets. Weve listed these for 2021 and 2022 below. The maximum Earned Income Tax Credit is 560 for no children 3733 for one child 6164 for two children and 6935 for three or more children.

This publication supplements Pub. Previous post Next post. There are seven federal tax brackets for the 2021 tax year.

15 Employers Tax Guide and Pub. Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca. This is up from 19500 in 2021.

Starting in 2022 the earned income tax credit is. However the tax brackets have been adjusted to account for inflation. 10 - on earnings 0 - 10275.

It describes how to figure withholding using the Wage Bracket Method or Percentage Method describes the alternative methods for figuring withholding and provides the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members. For individual single taxpayers. 10 12 22 24 32 35 and.

37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing. IRS unveils new federal income tax brackets for 2022. Heres a breakdown of the seven tax brackets the IRS announced for tax year 2022.

9 rows As was the case and due to Trumps Tax Cuts and Jobs Acts the the personal exemption remained 0. Irs unveils federal income tax brackets for 2022 syracuse. The IRS on Nov.

The tax rates will not change. The IRS has announced federal income tax brackets for 2022. Your 2021 Tax Bracket To See Whats Been Adjusted.

Single individuals earning up to 10275 and. 10 12 22 24 32 35 and a top bracket of 37. 0 percent for income up to 41675.

Irs Announces Inflation Adjustments To 2022 Tax Brackets The Economic Standard

Irs Guidance On Tax Matters For March 20 2022 March 26 2022

The Rich Pay A Lot In Taxes American Experiment

Key Retirement And Tax Numbers For 2022

/Form8880.ScreenShot2022-07-05at12.02.49PM-ef2c8c7c2181487fba28a314c04900db.jpg)

Form 8880 Credit For Qualified Retirement Savings Contributions

Irs Announces 2022 Tax Filing Start Date

2022 Estimated Income Tax Rates And Standard Deductions

Internal Revenue Service Announces Changes To Income Thresholds For 2022 Federal Income Tax Brackets Lasher Holzapfel Sperry Ebberson Pllc Jdsupra

Irs Announces 2016 Tax Rates Exemptions Boosts Ltc Deductions Thinkadvisor

New 2022 Irs Income Tax Brackets And Phaseouts For

Will The Irs Extend The Tax Deadline In 2022 Marca

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca